Property Tax Rate In Alameda County . If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. For the fiscal year 2021/2022. Please choose one of the following tax types. You can use the interactive map below to look up property tax data in alameda county and beyond! County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. Pay / look up property taxes online. Enter just one of the following choices and click the corresponding search button: The tax type should appear. Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. Compiled under the direction of. To find a tax rate, select the tax year.

from propertytaxgov.com

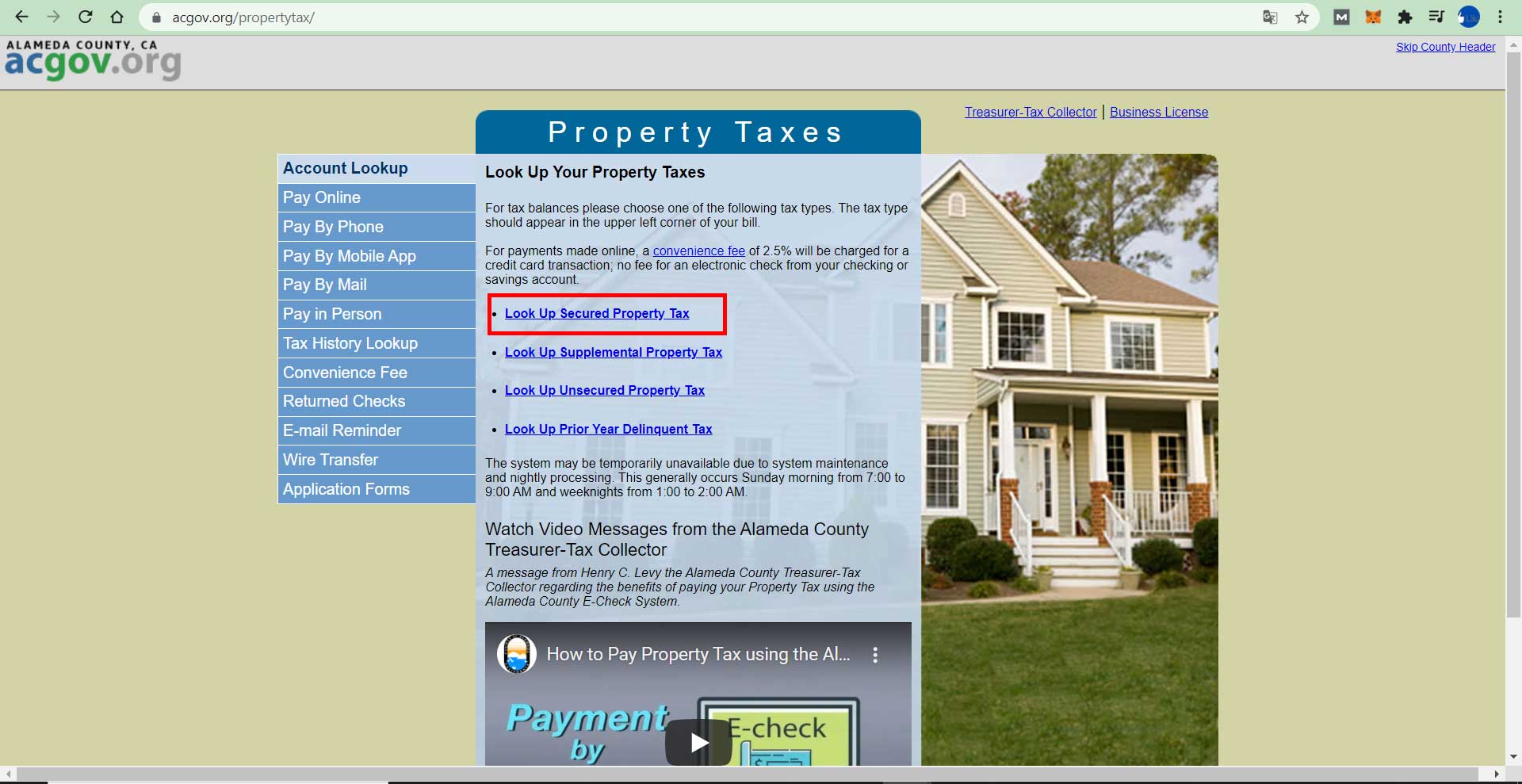

County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. Pay / look up property taxes online. For the fiscal year 2021/2022. Please choose one of the following tax types. If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. Compiled under the direction of. To find a tax rate, select the tax year. The tax type should appear. You can use the interactive map below to look up property tax data in alameda county and beyond! Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287.

Property Tax Alameda 2024

Property Tax Rate In Alameda County Enter just one of the following choices and click the corresponding search button: Pay / look up property taxes online. Enter just one of the following choices and click the corresponding search button: If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. The tax type should appear. You can use the interactive map below to look up property tax data in alameda county and beyond! Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. For the fiscal year 2021/2022. To find a tax rate, select the tax year. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. Please choose one of the following tax types. Compiled under the direction of.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate In Alameda County If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. Please choose one of the following tax types. To find a tax rate, select the tax year. Compiled under the direction of. Enter just one of the following choices and click the corresponding search button: Pay / look up property. Property Tax Rate In Alameda County.

From www.youtube.com

How to Pay Property Tax using the Alameda County ECheck System YouTube Property Tax Rate In Alameda County Pay / look up property taxes online. For the fiscal year 2021/2022. Please choose one of the following tax types. Compiled under the direction of. The tax type should appear. You can use the interactive map below to look up property tax data in alameda county and beyond! If the tax rate in your community has been established at 1.20%. Property Tax Rate In Alameda County.

From bekinsmovingservices.com

Alameda County Property Tax 🎯 2024 Ultimate Guide to Alameda County Property Tax Rate In Alameda County For the fiscal year 2021/2022. Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. Enter just one of the following choices and click the corresponding search button: Pay / look up property taxes online. County of alameda state of california tax rates. Property Tax Rate In Alameda County.

From www.countyforms.com

Alameda County Property Tax Form Property Tax Rate In Alameda County You can use the interactive map below to look up property tax data in alameda county and beyond! Please choose one of the following tax types. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. To find a tax rate, select the tax year. If the. Property Tax Rate In Alameda County.

From prorfety.blogspot.com

Property Tax History Alameda County PRORFETY Property Tax Rate In Alameda County You can use the interactive map below to look up property tax data in alameda county and beyond! Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. Enter just one of the following choices and click the corresponding search button: The tax. Property Tax Rate In Alameda County.

From andersonadvisors.com

Alameda County Property Tax Tax Collector and Assessor in Alameda Property Tax Rate In Alameda County The tax type should appear. Please choose one of the following tax types. Compiled under the direction of. Pay / look up property taxes online. Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. To find a tax rate, select the tax. Property Tax Rate In Alameda County.

From www.datos.org

Alameda County Property Tax Rate, Due Dates, Lookup, and Amount DATOS Property Tax Rate In Alameda County Enter just one of the following choices and click the corresponding search button: To find a tax rate, select the tax year. Please choose one of the following tax types. If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. Residents of alameda county, where the median home value is. Property Tax Rate In Alameda County.

From propertytaxgov.com

Property Tax Alameda 2024 Property Tax Rate In Alameda County Enter just one of the following choices and click the corresponding search button: Please choose one of the following tax types. To find a tax rate, select the tax year. Compiled under the direction of. You can use the interactive map below to look up property tax data in alameda county and beyond! The tax type should appear. County of. Property Tax Rate In Alameda County.

From propertytaxgov.com

Property Tax Alameda 2024 Property Tax Rate In Alameda County Pay / look up property taxes online. If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. You can use the interactive map below to look up property tax data in alameda county and beyond! To find a tax rate, select the tax year. Residents of alameda county, where the. Property Tax Rate In Alameda County.

From propertytaxgov.com

Property Tax Alameda 2024 Property Tax Rate In Alameda County To find a tax rate, select the tax year. The tax type should appear. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. Compiled under the. Property Tax Rate In Alameda County.

From propertytaxgov.com

Property Tax Alameda 2024 Property Tax Rate In Alameda County If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. Pay / look up property taxes online. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. To find a tax rate, select the tax year. Enter. Property Tax Rate In Alameda County.

From oaklandside.org

Meet the 4 candidates running for Alameda County Supervisor District 3 Property Tax Rate In Alameda County Pay / look up property taxes online. The tax type should appear. If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. To find a tax rate, select the tax year. For the fiscal year 2021/2022. You can use the interactive map below to look up property tax data in. Property Tax Rate In Alameda County.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Tax Rate In Alameda County Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88% for a median tax bill of $7,287. You can use the interactive map below to look up property tax data in alameda county and beyond! To find a tax rate, select the tax year. Pay / look up property taxes. Property Tax Rate In Alameda County.

From bekinsmovingservices.com

Alameda County Property Tax 🎯 2024 Ultimate Guide to Alameda County Property Tax Rate In Alameda County Compiled under the direction of. You can use the interactive map below to look up property tax data in alameda county and beyond! Enter just one of the following choices and click the corresponding search button: Please choose one of the following tax types. To find a tax rate, select the tax year. The tax type should appear. If the. Property Tax Rate In Alameda County.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax Rate In Alameda County To find a tax rate, select the tax year. For the fiscal year 2021/2022. The tax type should appear. If the tax rate in your community has been established at 1.20% (1% base rate plus.20% for prior indebtedness) the. Enter just one of the following choices and click the corresponding search button: County of alameda state of california tax rates. Property Tax Rate In Alameda County.

From propertytaxgov.com

Property Tax Alameda 2024 Property Tax Rate In Alameda County Please choose one of the following tax types. Enter just one of the following choices and click the corresponding search button: Pay / look up property taxes online. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. You can use the interactive map below to look. Property Tax Rate In Alameda County.

From propertytaxgov.com

Property Tax Alameda 2024 Property Tax Rate In Alameda County Pay / look up property taxes online. The tax type should appear. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. For the fiscal year 2021/2022. Residents of alameda county, where the median home value is $825,300, pay an average effective property tax rate of 0.88%. Property Tax Rate In Alameda County.

From thebharatexpressnews.com

Alameda County lowers property taxes for select homeowners THE BHARAT Property Tax Rate In Alameda County You can use the interactive map below to look up property tax data in alameda county and beyond! To find a tax rate, select the tax year. For the fiscal year 2021/2022. County of alameda state of california tax rates for the fiscal year july 1, 2023 to june 30, 2024 code area index page. If the tax rate in. Property Tax Rate In Alameda County.